Alberta Auto Insurance Changes

As of January 1, 2022, all automobile policies in Alberta include mandatory coverage for Direct Compensation Property Damage (DCPD) according to the recently actioned Bill 41: The Insurance (Enhancing Driver Affordability and Care) Amendment Act. This coverage makes claiming damages to your vehicle faster and easier, as you will now deal with your insurance company directly, regardless of fault.

What Does This Mean?

There is no action required by auto insurance policyholders as DCPD coverage is a change to the way that vehicle damage claims are handled in Alberta.

If you are involved in an accident where you are not at fault, your insurance company will pay for the repairs to your vehicle. This will result in a fairer and more customer service-oriented approach to claims. Damages will be repaired faster and without delays or complications that can arise when dealing with another driver’s insurance company.

Damages to Me and My Vehicle

Regardless of fault, there is no change to the process of claiming for injuries sustained in a motor vehicle accident.

DCPD streamlines the claims process for consumers as claims are now processed by your insurance provider.

- If you are found 100 per cent not at-fault for an accident:

Any vehicle repairs and required loss of use coverage (rental car, taxi, etc.) will be paid for through your DCPD coverage. - If you are found 100 per cent at-fault for an accident:

If you have collision coverage, repairs to your vehicle will be paid through this coverage, subject to your deductible. If you don’t have collision coverage, you will have to cover any costs for damage to your own vehicle out of pocket. - If you are found fifty per cent at-fault:

If you have collision coverage, fifty per cent of the vehicle repairs will be paid through your DCPD coverage, and fifty per cent of the damages will be paid through your collision coverage. You will be responsible for fifty per cent of your collision deductible.

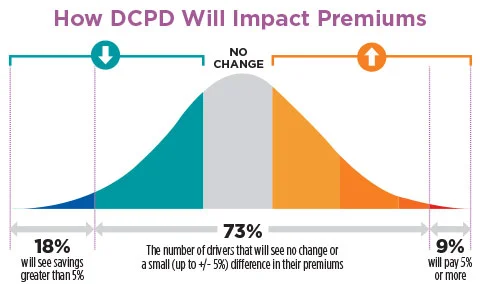

How Will This Affect My Premium?

The expectation of this legislative change is that it will assist in steadying insurance premiums in the long run by aligning them with the costs associated with repairs for a vehicle. Generally, owners of less expensive vehicles that cost less to repair will end up paying less for their insurance. Similarly, owners of more expensive vehicles that cost more to repair may pay more.

Approximately fifty-five per cent of all policyholders will see either no change or a reduction in premium due to this update. The graphic on page 48 outlines the expected premium effect for all automobile insurance holders in Alberta.

Get the Help You Need

A qualified broker will answer any questions that you may have about the introduction of DCPD coverage and your insurance.