Income Streams During Retirement

by Melissa Arenas | Senior Financial Adviser ATB Securities Inc.

The Main Sources of Retirement Income

Understanding the three main sources of retirement income:

- Canada Pension Plan (CPP)

Basic CPP program is designed to replace 25% of pre-retirement pensionable earnings. - Old Age Security (OAS)

Government of Canada’s largest pension program and it is funded from general tax revenues. - Registered Retirement Income Fund (RRIF)

Converting RRSPs to a RRIFs is currently the most common choice amongst Canadians.

Canada Pension Plan (CPP)

Contributions

- Based on age & income

- As of June 20,2020 $434.4 billion managed by CPP investments

- 2019 CPP enhancement

- Contributions after 65 = Post Retirement Benefit

Entitlement

- Based on age & contributions

- 17%, child rearing & CPP disability dropout provisions

- Statement of Contributions on My Service Canada Account

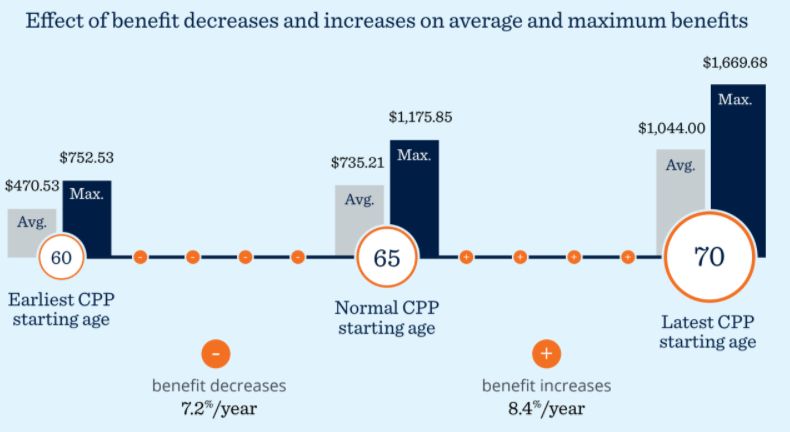

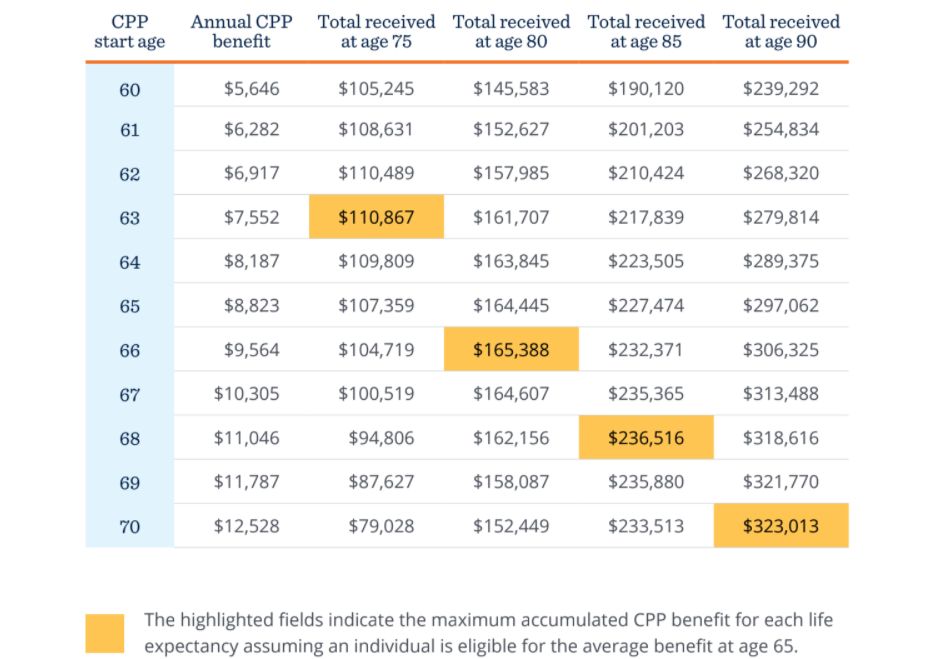

CPP Benefits

When Should I Collect CPP?

For illustrative purposes, assumed annual benefit of $8,823 receivable at 65 year old today. Based on the average pensioner payment as of January 2020. Assumed benefits increase 2% per year.

Key Considerations

Taxable Income: Have you stopped working?

Income Need: Do you need CPP to fund your lifestyle?

Investment Opportunities: Is your return over 7.2% per year?

Life Expectancy: Most important/ hardest to answer

Old Age Security (OAS)

Contributions

- No contributions

- Government benefit paid out of general revenues

Entitlement

- Based on residency in Canada

- Canadian citizen or legal resident at time of application

- Minimum 10 years of residency after age 18 (20+ after age 18 if applying outside of Canada)

OAS Benefits

When should I collect OAS?

Key Considerations

Taxable Income: Have you stopped working? OAS clawback ($79,045-$128,137)

Life Expectancy: No survivor benefits

Registered Plans

Registered Retirement Savings Plans (RRSP, SRSP)

Options at maturity

- Annuity

- RRIF

- Cash

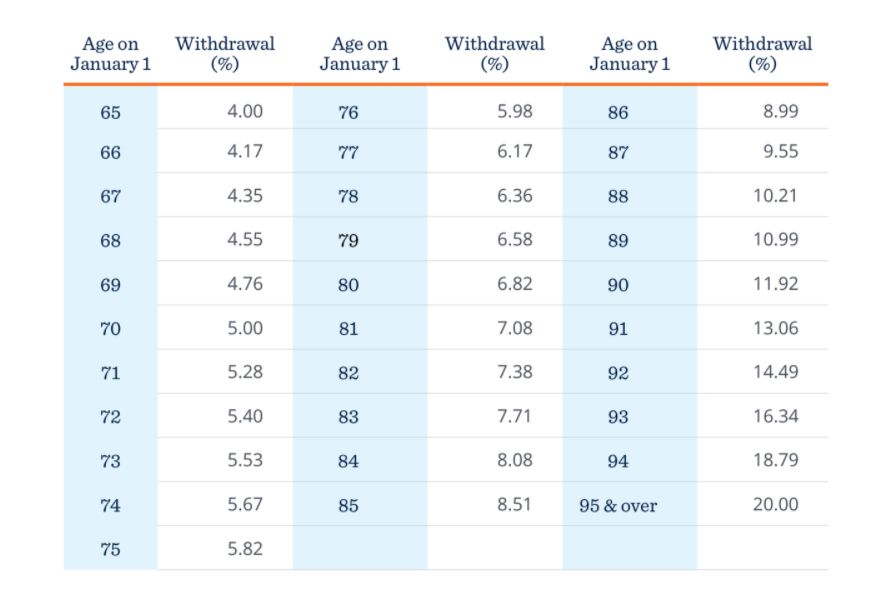

Retirement Income Fund (RRIF)

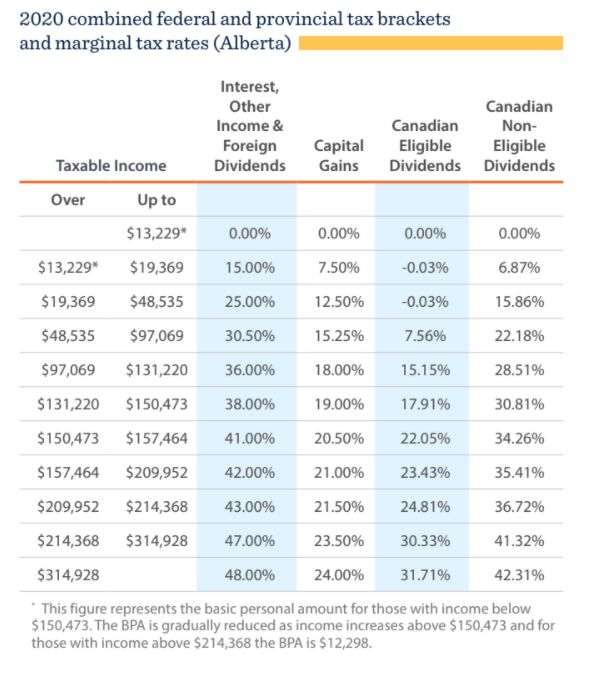

RRIF Taxation & Withholding Tax

- Total value of annual RRIF withdrawals are taxable

- Withholding tax only required to be withheld on amounts above the minimum annual payment

10%- up to $5000

20% $5,000 – $15,000

30%- $15,000+

RRIF Withdrawal Planning

Pension income splitting and the pension income credit

Spousal RRIFs and attribution rules

The Traditional approach:

- exhaust non-registered accounts

- Access TFSA investments

- Convert RRSPs to a RRIF and initiate withdrawals

Key Considerations

Age to Convert: You don’t have to wait until 71

Taxable Income: Consider anticipated taxable income from all sources

Pension Splitting: Eligible for pension income splitting, when the RRIF annuitant is age 65+

Investment approach: Review

Summary

Your CPP, OAS and RRIF income may provide a significant portion of your available sources of income in retirement. There are multiple factors you will need to weigh in deciding when to commence payments from each. Work with an ATB Wealth adviser to create a personal retirement plan that illustrates the impact of these benefits on your retirement finances.

Disclosure

This report has been prepared by ATB Investment Management Inc. (“ATBIM”) which manages the Compass Portfolio Series. ATB Wealth consists of a range of financial services provided by ATB Financial and certain of its subsidiaries. ATB Investment Management Inc., ATB Securities Inc., and ATB Insurance Advisers Inc. are individually licensed users of the registered trade name ATB Wealth. ATB Securities Inc. is a member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada.

The information provided is a simplified general summary and is not intended to replace or serve as a substitute for professional advice. Professional tax

advice should always be obtained when dealing with taxation issues as each individual’s situation is different. This information has been obtained from

sources believed to be reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. This information is

subject to change and ATB Investment Management Inc. reserves the right to change the information without prior notice, and does not undertake to provide updated information should a change occur. ATB Financial, ATB Investment Management Inc. and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this document or its contents.

This report is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.